Thoughts on N032-N038

The first thing I do after assay results are released is go straight to the 3D viewer by Vrify! It can be difficult to visualize the deposit in three dimensions but Vrify does an excellent job at this, allowing everyone to fly around the ore body virtually. Kudos to Oroco for updating the viewer basically simultaneously with the release of assay results!

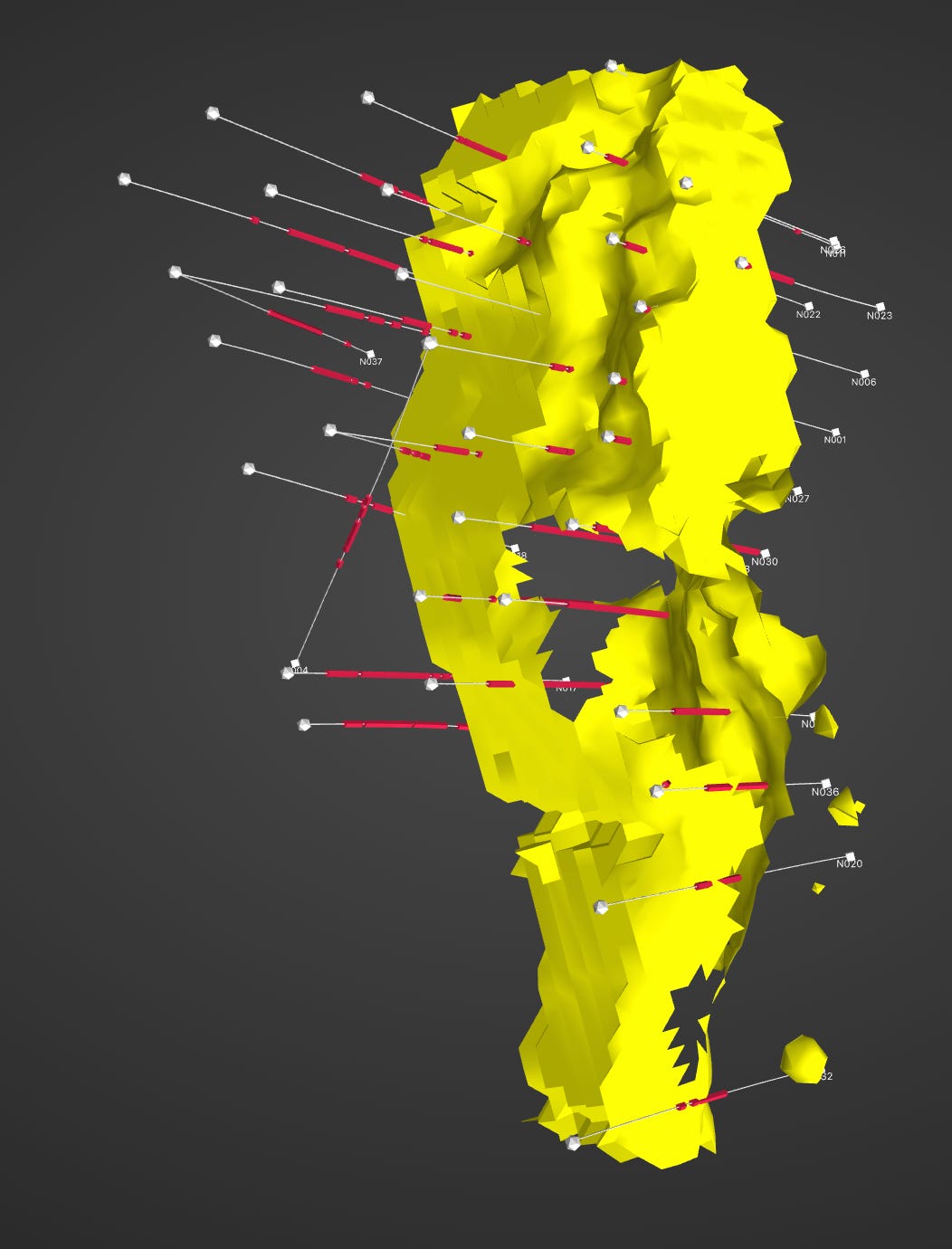

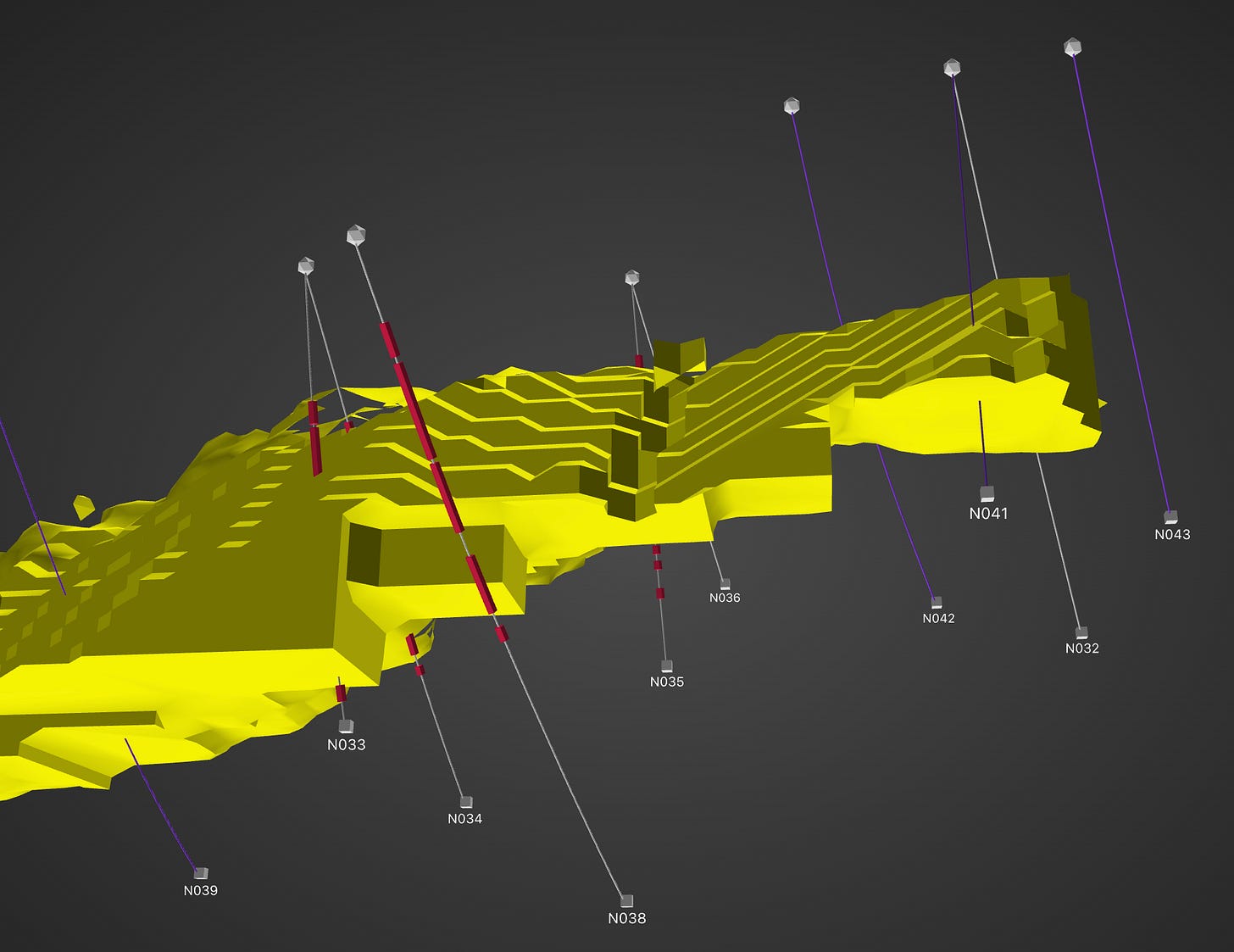

A top-down view of the historical NZ high-grade core (>0.3% CU) with all completed drill holes turned on shows how the NZ drill campaign is clearly nearing its end. The northern 2/3 of the NZ have been methodically turned into Swiss cheese and westward extensions have been pursued almost to the river’s edge. More on that later.

In the southern 1/3 of the NZ some work remains. My understanding is that the focus here is mainly on expanding the core, in an area that was historically drilled only sparsely. Due to this lack of historical data, the modeled high-grade core is substantially less thick and wide than in the more thoroughly explored northern portion of the NZ.

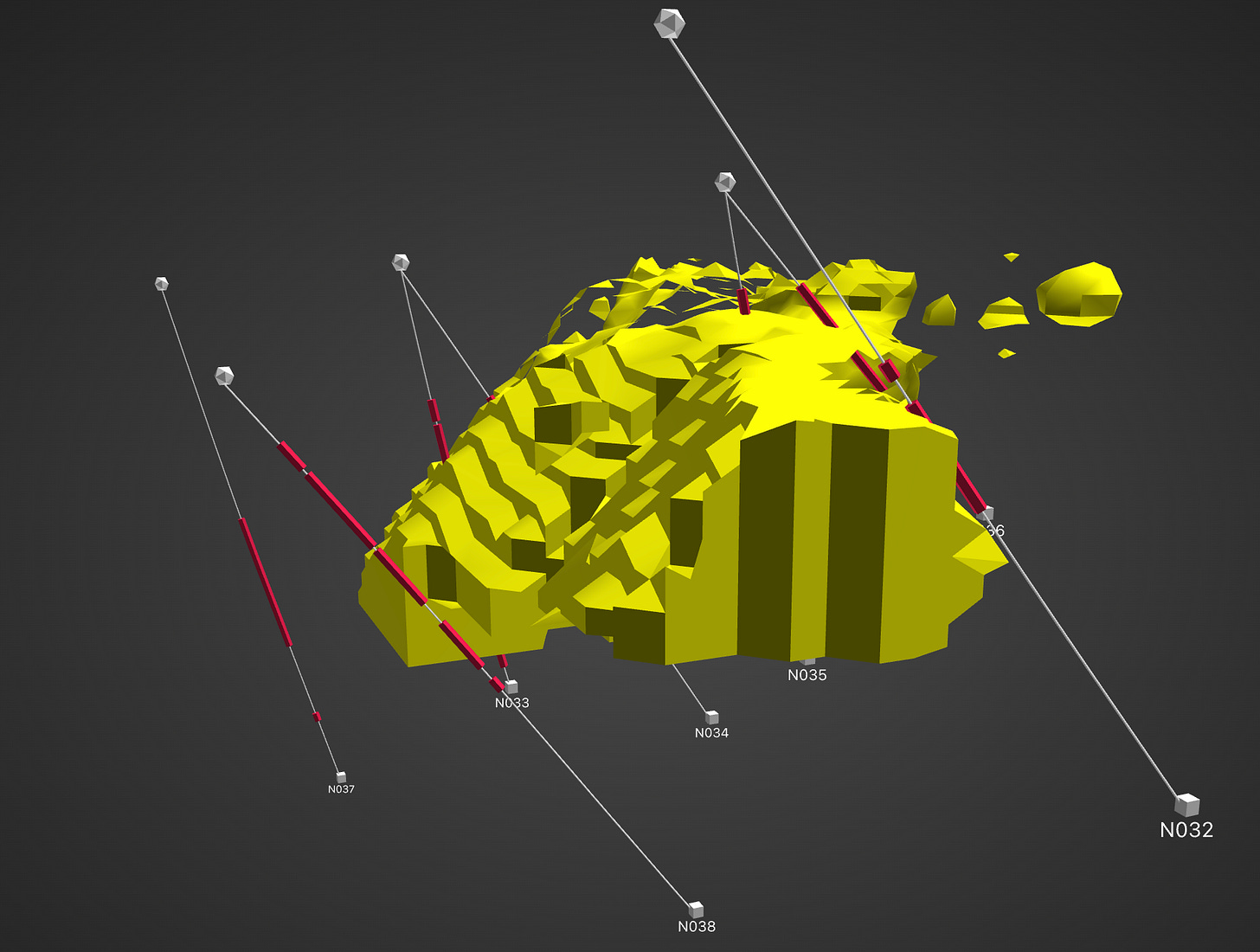

We can see that N038 continued the effort of widening the core in the southern area of the NZ. It found mineralization in the 0.3% Cu range adjacent and above the historical core. One can easily see how the actual shape of the ore body in the southern part of the NZ was not accurately captured by historical drilling. Most likely it will look more similar to other parts of the NZ, thicker and wider.

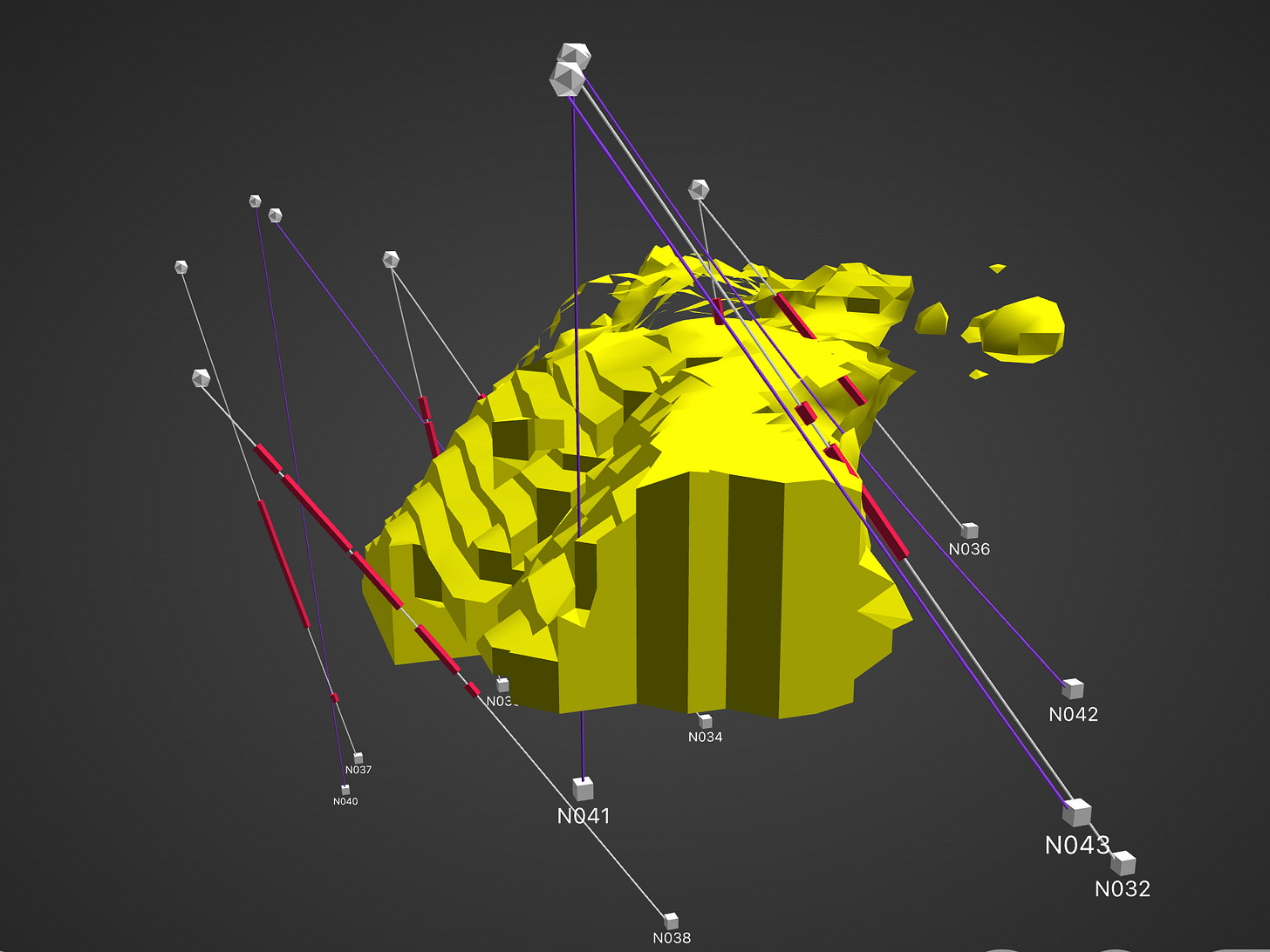

One can see that upcoming holes N041, N042, and N043 also aim at expanding the historical core in this zone. N042 and N043 will test for mineralization above and below the core to the east of the grade shell, while N041, the company’s first vertical hole at Santo Tomas (I think), will look for expansion to the west.

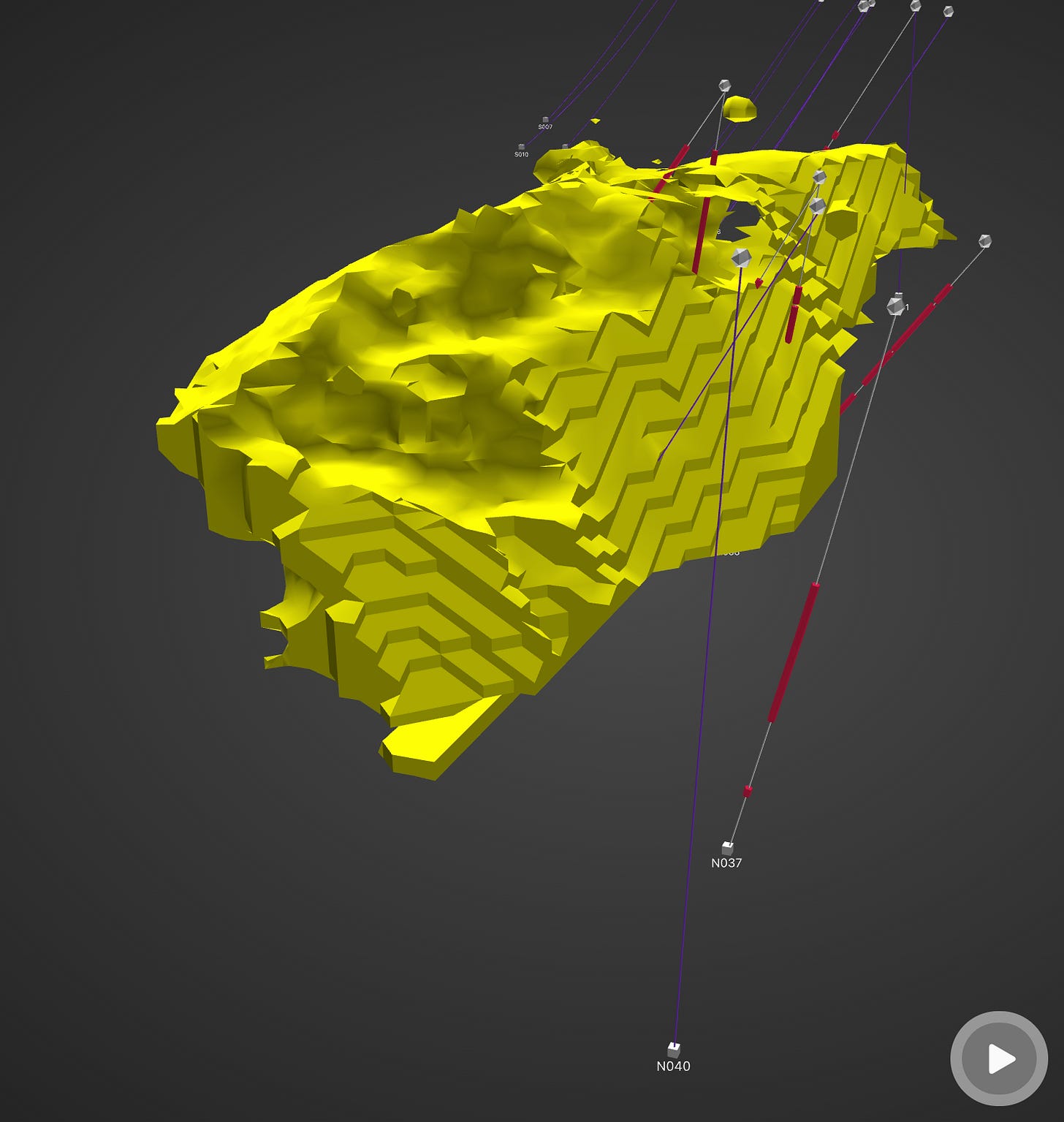

Spinning the ore body 90 degrees one can see how additional holes to the right (south) of N038 will be needed to continue expanding this part of the NZ to the west. However due to surface topography road access in this area is limited. During the site visit earlier this month we learned that the company is putting together plans on how to gain access and drill holes that will check for mineralization in this area.

Below is another perspective that shows how much thinner the historically-defined core is in this southern part of the NZ and how N038 made a successful start in expanding the core to more closely match the width and thickness of the northern sections of the NZ.

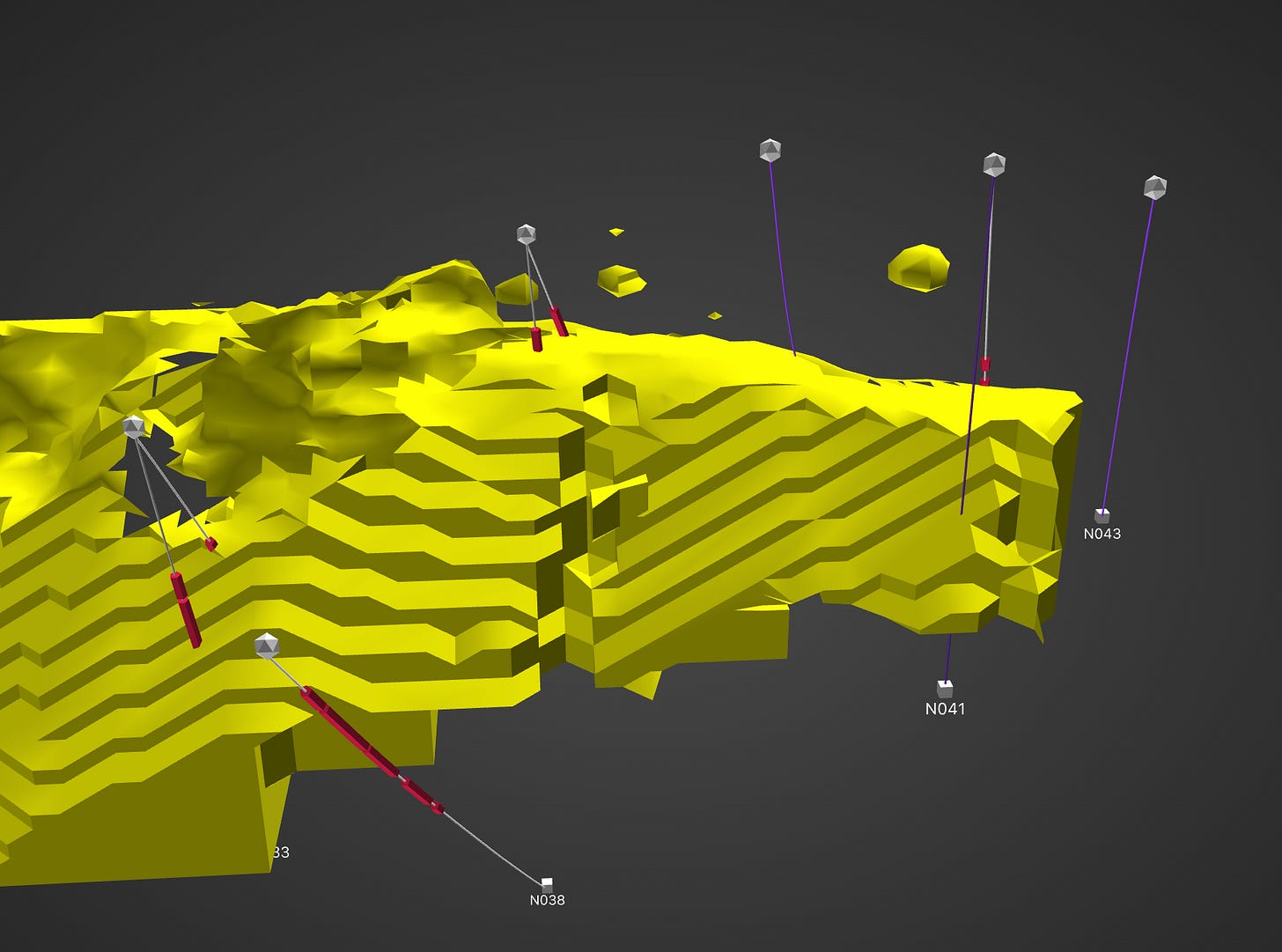

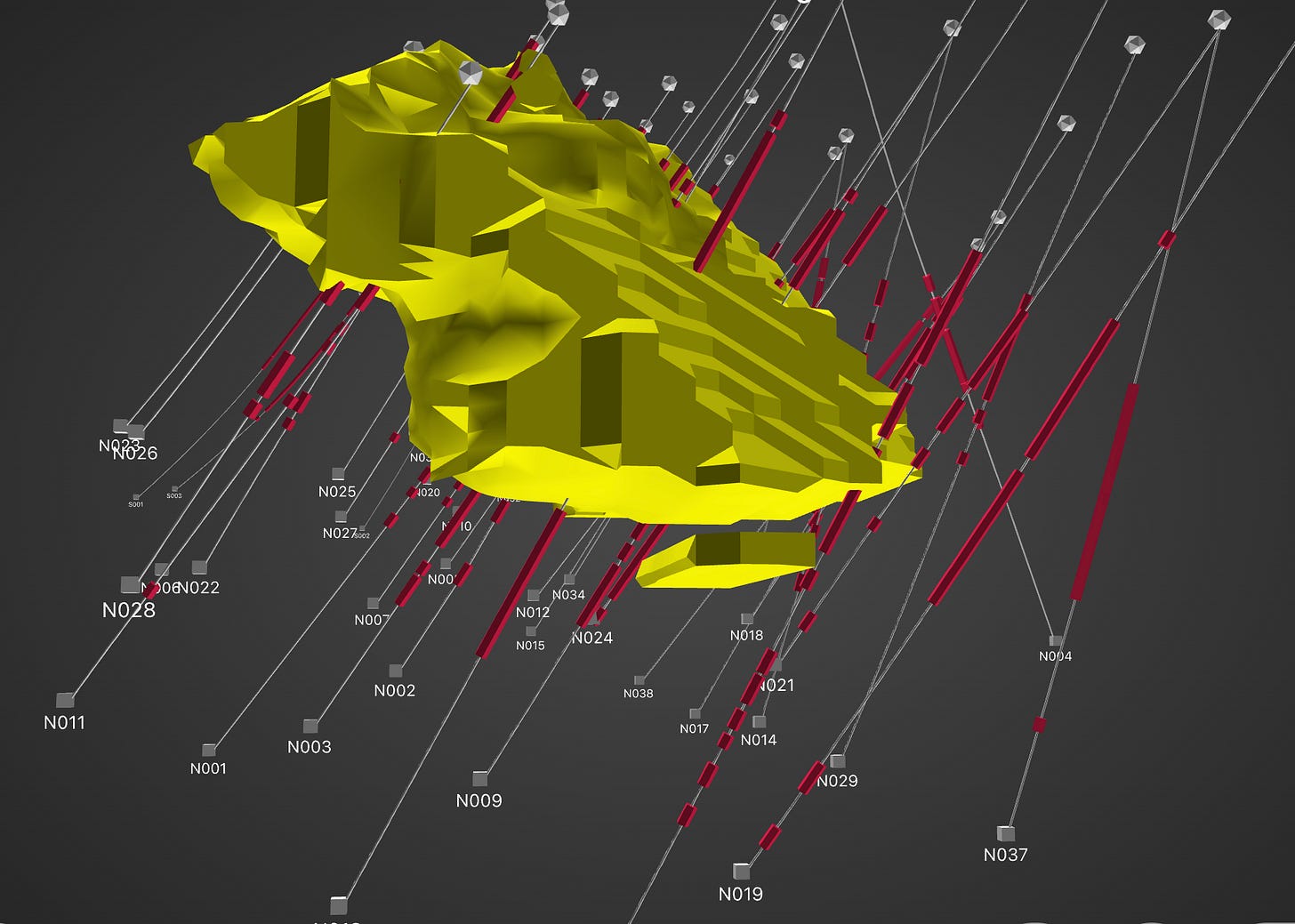

Speaking of the northern section of the NZ; this image with all completed NZ holes turned on, unequivocally shows how the NZ ore body will be dipping much more gently to the west (the right in the image below) as drilling efforts found lots of mineralization above the core. Furthermore, step-out holes have confirmed that the core is wider than historical data suggested.

In combination this results in more ore, more ore closer to surface, and a reduced strip ratio, since rock that previously had to be mined as waste, has been turned into mineable ore.

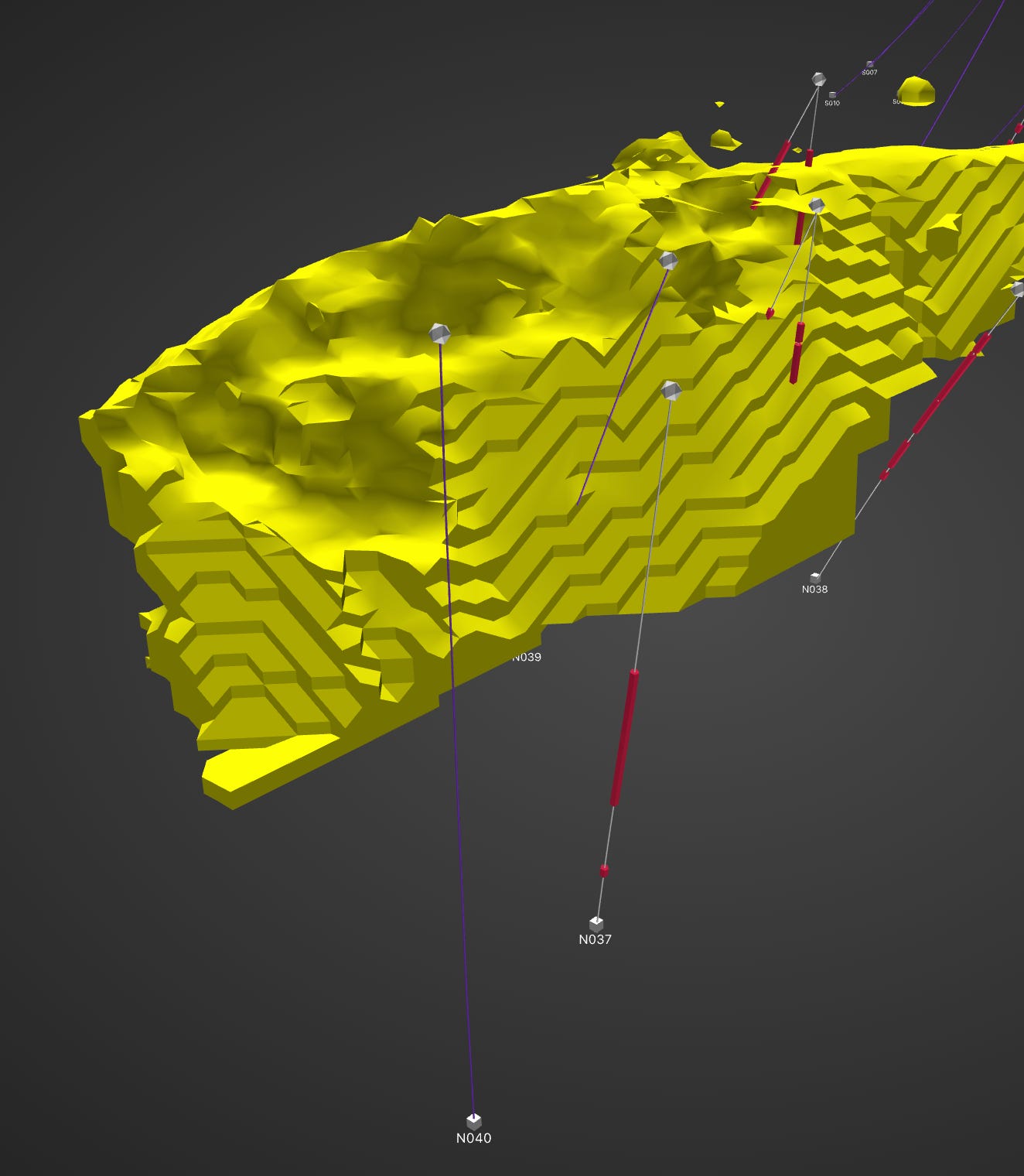

The 3D viewer again helps understand what N037 and N038 accomplished and what work remains to be done. N037 provides for a massive step-out to the west (right in the image below). While the grade is relatively mediocre, a solid 192m chunk of mineralization at 0.26 CuEq will turn a large part of the material that has to be mined to expand the pit at depth from waste into mineable ore. That is accretive to Santo Tomas’ value.

Similarly, N038 slightly to the south produced almost 300m of mineralization and at higher grade than N037.

Not much remains to be drilled in this zone. We got two more holes pending, N039 and N040. With those two holes the west slope expansion will likely be complete and the company will have all the data they need to come up with an updated and significantly expanded high-grade NZ core. These new figures will be part of the Mineral Resource estimate and the subsequent PEA, which the company suggests will be ready in Q1 or early Q2 of 2023.

NOTE: Not investment advice! Do your own due diligence! My thoughts and comments above are based on my own interpretations and analyses and should not be used to make investment decisions!